About Silver Coins

Why Buy Silver?

Treasured for thousands of years for ornamental purposes because of its scarcity, aesthetic appeal, and antimicrobial properties, silver has in more recent history become prized as a superior catalytic substance and malleable conductor of thermal and electric energy. The electronics manufacturing, industrial, and healthcare industries often incorporate the soft white metal into the design and production of technology components and merchandise.

Thus the demand for silver continues to rise, and many precious metals companies extol the “investment” opportunities of silver and other precious metals. Precious metal purchases are IRA eligible and exempt from sales tax in some states, such as Texas. Silver and the other metals are better described as an insurance policy than a dividend-producing investment, although there are certainly speculative opportunities in inflationary markets.

In other words, precious metals serve as a store of wealth but are not producers of wealth. Partly for this reason, precious metals might be better classified as an alternate currency. If silver rises from $16 per ounce to $80 per ounce, the owner is not necessarily five times wealthier. Silver’s true value is not measured in nominal (dollar) terms, but in relation to other assets. In other words, if silver becomes five times more expensive in dollar terms while cars, homes, food, the stock market, etc., also become five times more expensive, you have simply retained purchasing power, not increased it.

Factors to Consider When Deciding Between Silver and Gold

While price plays a key role in the decision to buy silver or gold, several other important factors influence the decision process:

- risk tolerance

- economic crisis hedge

- supply-demand ratio

- size and weight properties

The decision to purchase silver or gold is heavily predicated on purpose and risk tolerance. For those approaching retirement age or seeking insurance for a portfolio or currency hedge, gold tends to be a more popular option. For those with greater speculative appetite, silver offers (in the opinion of some) higher upside potential. Additionally, for survivalists concerned with systemic risk or an apocalyptic shock, silver tends to be valued as a solution for trading or bartering in smaller quantities.

Some precious metals enthusiasts monitor closely the gold-to-silver price ratio, which represents the number of ounces of silver needed to purchase an ounce of gold. Historically, this relationship has ranged anywhere between 10:1 and 20:1, but the ratio has been much larger in recent decades.

A final consideration is size. A $100,000 order of silver could weigh 350 pounds, while a comparable gold order would weigh only 6 or 7 pounds (depending on price). When accounting for the stark per-ounce price differential, it is important to note that silver is significantly bulkier than gold.

Brief History of Silver

Silver is the naturally occurring periodic table element 47 whose symbol is Ag, from the Latin word "argentum" meaning "silver." The name is derived from the Anglo-Saxon word "siolfur" meaning "silver." Archaeological evidence suggests silver mining originated in the regions surrounding Asia Minor approximately 3,000 BCE. Documentation dated ca. 2500 BCE reveals ancient Chaldeans in Anatolia (modern-day Turkey) created a sophisticated ‘cupellation’ process to extract silver from lead-silver ores. Silver coins were not minted in the eastern Mediterranean until about 550 BCE, however.

Two thousand years later, Columbus’s 1492 landing in the New World led to the discovery that silver was abundant in the Americas. Spanish European investors subsequently conquered and enslaved native populations, forcing them to mine so much silver that Bolivia, Peru, and Mexico accounted for over 85 percent of world silver production and trade between 1500 and 1800.

The most common silver coin between the late-16th and late-19th centuries was the Spanish eight reales, or “piece of eight,” which circulated as international currency as global trade flourished.

Where Silver Comes From: Mining

Much of the world's silver is acquired as a by-product of extracting lead from galena mines. Galena is a lead sulfide mineral whose crystalline composition sometimes contains silver. Often, the value of silver present in a mine’s galena ore far exceeds the value of the lead. Unfortunately, lead is a highly toxic material, so early miners of silver were often poisoned by the lead. Most of the enslaved South American lead-and-silver miners, for example, who extracted 70,000 to 150,000 tons of silver between 1500 – 1800, died of lead poisoning within two or three years.

Because silver in its natural state is combined with other minerals such as gold, lead, and copper, nearly half of the silver mined today is obtained when miners are processing other kinds of ore. The chemical process of smelting extracts silver from the ore.

What Is the Difference Between Sovereign and Private Mints?

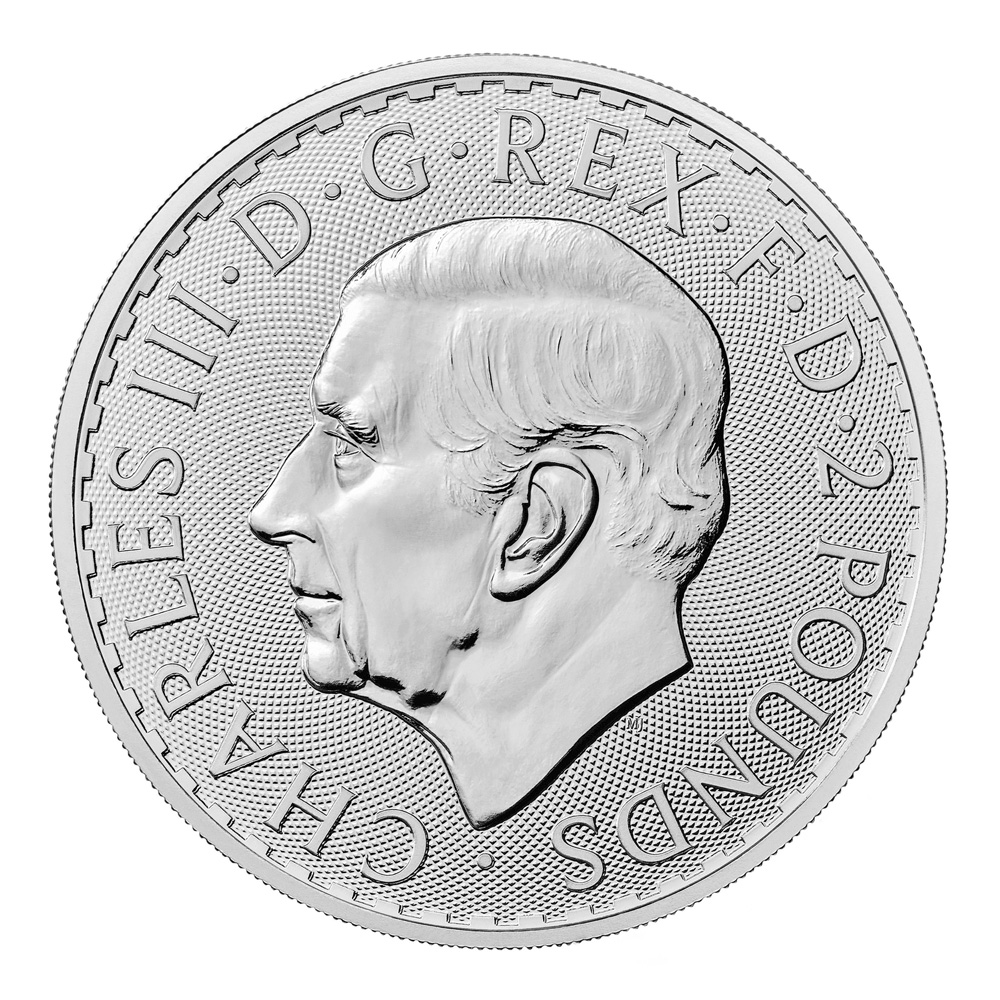

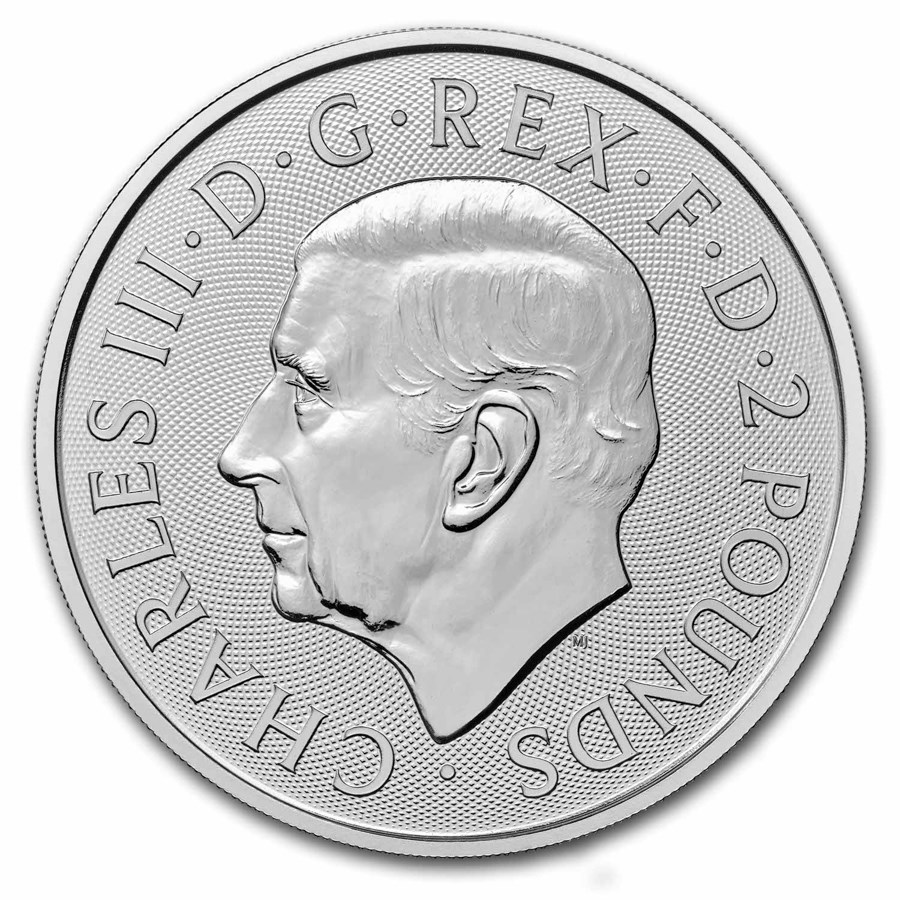

Silver products produced by sovereign mints and private mints offer the same silver weight, form factor, and purity (ranging from .999 to .9999 pure depending on product). The premiums on products from sovereign mints, however, vary depending on the level of government bureaucracy and taxation. Some clients prefer the “official” designation of a sovereign coin, while others prefer to acquire silver in their desired form factor at the lowest cost. It is a matter of personal preference.

Which Are the World’s Best Mints?

Clients purchasing silver products from Texas Precious Metals may choose from among those minted by several of the world’s most reputable, internationally recognized mints, including the United States Mint, the Australian Perth Mint, the Austrian Mint, and the Royal Canadian Mint. In recent years, the Texas Mint has also become a very popular option due to its purity (.9999) and price.

Some of these mints have been in operation for over a hundred years, demonstrating remarkable longevity, admirable tenacity, and impressive stability:

The United States Mint, founded in 1792, operates facilities in Denver, Philadelphia, San Francisco, and West Point, New York.

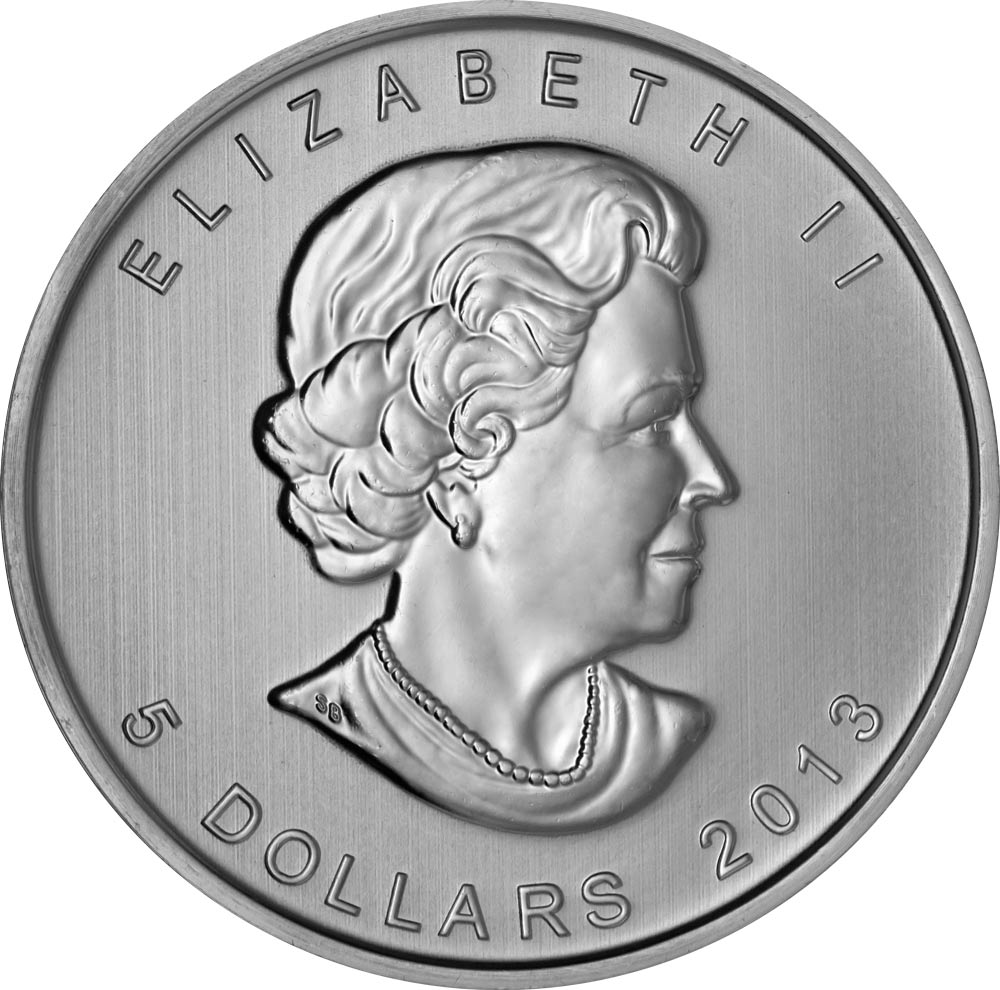

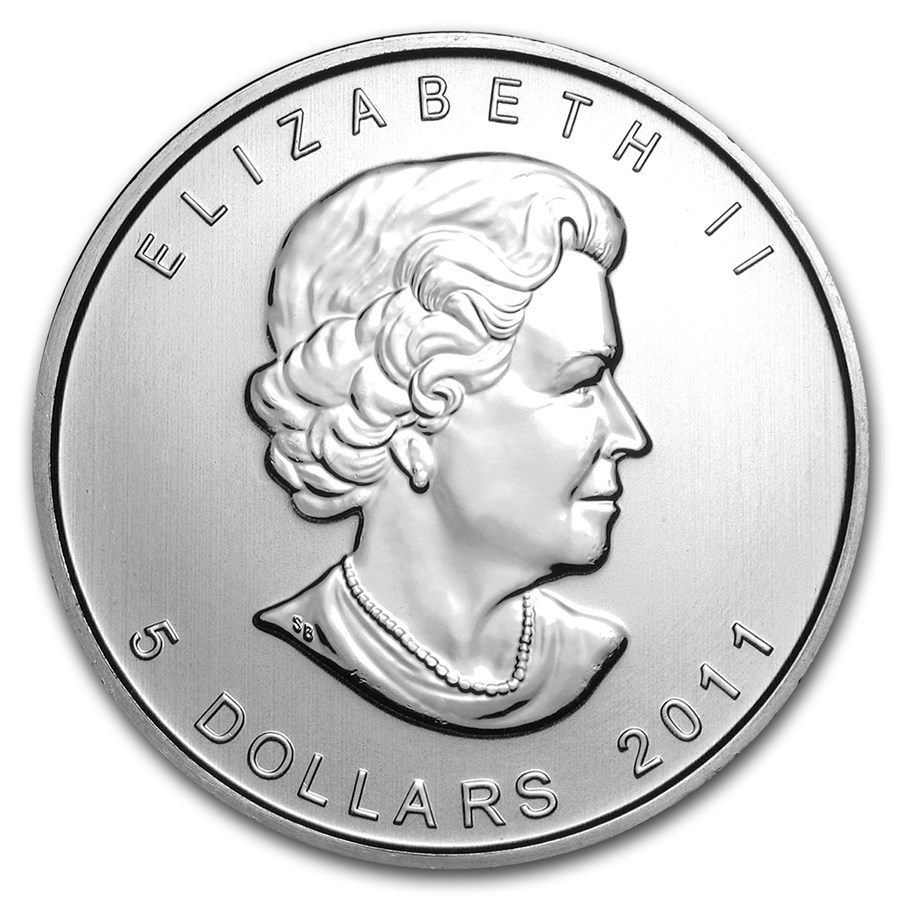

The Royal Canadian Mint (RCM), founded in 1908, produces more than 1 billion coins per year in Ottawa, Ontario, for dozens of countries; its most popular product is the Silver Maple Leaf.

The Perth Mint, founded in 1899, refines 400 tons of gold annually in Perth, Australia; governed by the United Kingdom Royal Mint, ownership was transferred to the State Government of Western Australia in July 1970.

PAMP Suisse Mint, a private mint founded in 1977, operates in Switzerland, refining 450 tons of gold annually.

About the Texas Mint

The Texas Mint promotes the Lone Star State, of which it has been said, “no country upon the globe can compare with it in natural advantages” (Sam Houston). More specifically, the Texas Mint:

- guarantees the weight and purity of every product sold

- has as the heart of all its design themes the Texas State Capitol building, a state icon

- distributes most of its silver and gold to top US dealers through Amark Precious Metals

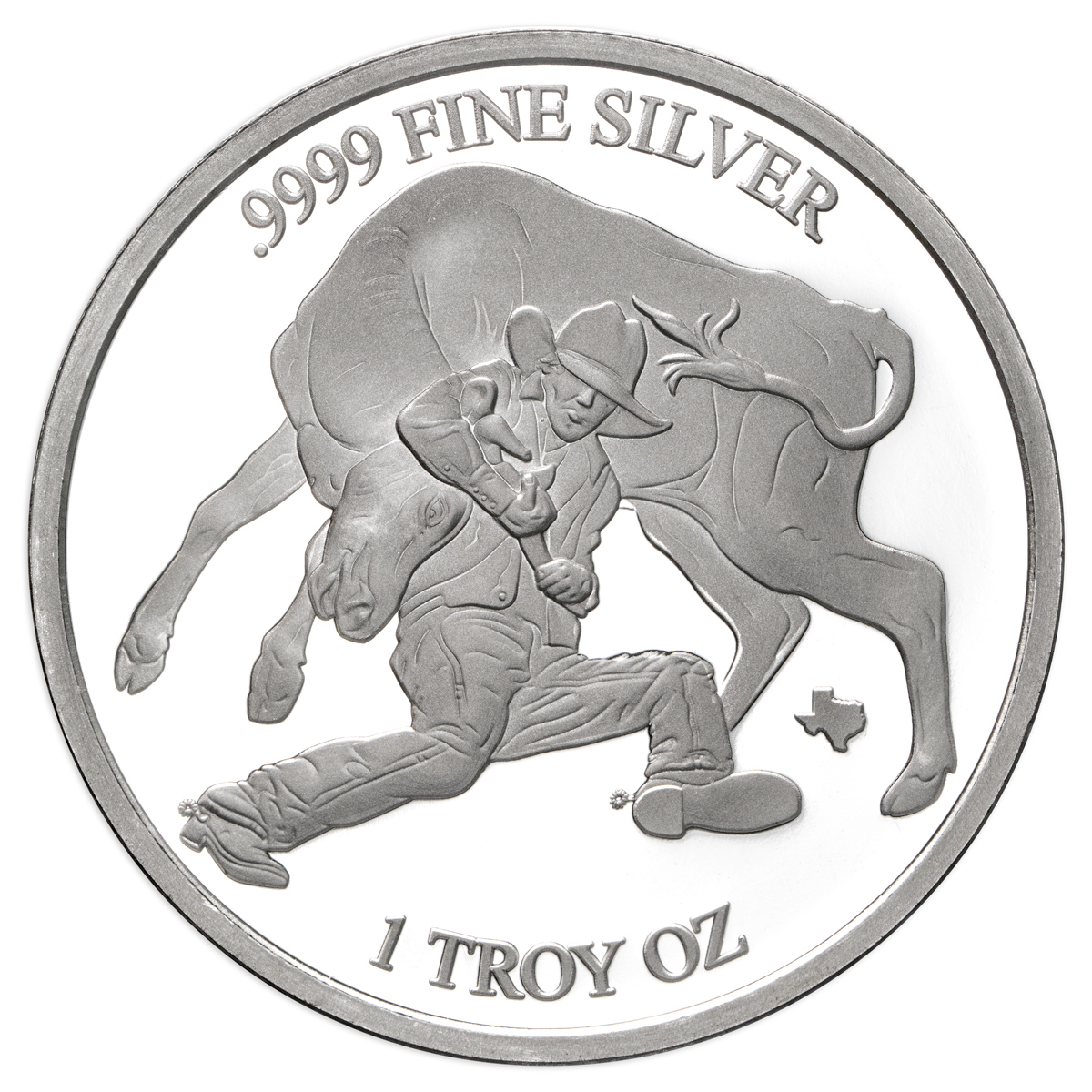

n 2017, Texas Precious Metals spun off the Texas Mint as its own division with the purpose of expanding the product line and distributing these products to other national dealers. The Texas State Capitol is the theme for all of these products, which include one ounce gold rounds, one ounce silver bars, ten ounce silver bars, one hundred ounce silver bars, and the popular one ounce Texas Silver Round.

The current Texas State Capitol in Austin took eight years and over 1,000 people to build. Finished in 1888, the Texas Sunset Red granite structure in the Italian Renaissance Revival architectural style was topped off with a 16-foot tall zinc statue of the Goddess of Liberty, the inspiration for the Statue of Liberty imagery used throughout the United States.

A-Mark Precious Metals, Inc.(NASDAQ:AMRK), (“A-Mark”), a full-service precious metals trading company and an official distributor for all the major sovereign mints, is the exclusive distributor for the Texas Mint. The catalog of Texas Mint products, including gold and silver rounds and bars, is sourced, manufactured, and distributed through A-Mark’s vertically integrated subsidiary businesses.

What Are the Options for Buying Silver Bullion?

Just as with gold, there are three main considerations for silver product selection: premium cost, country of origin, and sell-side tax. An additional consideration is form factor. When choosing to purchase silver, buyers have several options; each format offers advantages:

- Jewelry: very portable; artistry and craftsmanship commend it perfect for gifting

- Bullion: silver in the form of coins, rounds, and bars that are at least 99.9% pure; trade and commerce instrument

- Official Coins: silver coins issued by a sovereign (government) mint; legal tender

- Rounds (Medallions): a round silver piece resembling a coin but non-legal tender, issued by either sovereign or private mints; aesthetically-appealing designs and collectability

- Junk Silver: old, circulated silver coins; value is based upon the silver content; has no numismatic value

What Is the Difference Between a “Round” and a “Coin”

A round is a privately minted, non-legal tender medallion in the size and shape of a coin. In contrast, a coin is a product minted by a sovereign mint and it has legal-tender face value.

Differences between a round and a coin:

- minting - sovereign vs. private

- legal tender vs. non-legal tender value

- premiums and price

- design varieties

Both options offer the same weight, form factor, and purity (ranging from .999 to .9999 pure depending on product). The round, however, tends to sell at a lower premium because private mints are not subject to the same financial burdens — and taxation — as sovereign mints. Some clients prefer the “official” designation of a sovereign coin, while others prefer to acquire gold in their desired form factor at the lowest cost. It is a matter of personal preference.

For clients seeking the largest quantity of silver for the least cost (i.e. the best bang for the buck), 100-ounce and 10-ounce bars are a common solution, along with 1-ounce silver bars and silver rounds, such as the Texas Silver Round.

For institutional investors, 1,000-ounce bars are also an option. Due to the weight (>70 lbs), these are not generally preferable for retail investors.

Which Is Better: Collectible Coins or Bullion Coins?

Purchasing collectible coins is like purchasing a piece of art. Generally, the value resides not in the metal content, but in the rarity, artistry, or desirability of the coin. So, in evaluating collectible coins, it is critically important to recognize that there are hefty premiums on these coins that sometimes far exceed the metallic value. If you desire collectible coins, ensure that your motivation is not for currency-like fungibility (i.e. easily and quickly convertible into an instrument of equal value).

What Is Junk Silver?

“Junk” silver is an industry term for pre-1965 U.S. dimes, quarters, half-dollars, and dollars. These coins are composed of 90% silver. Since they were at one time in common circulation, they generally have significant wear when compared to “brilliant uncirculated” coins or rounds. Certain clients are attracted to junk silver because these coins represent the smallest form factor available for silver products, and the premiums tend to be comparable to 1 oz. silver coins on a per ounce basis. In other words, there is generally no significant increase in premium despite the smaller size. It is worth noting, however, that these premiums tend to fluctuate more than newly minted products due to finite supplies. The US Mint no longer produces these coins. Hence, there are acute supply/demand sensitivities in the junk silver market that can lead to higher premiums during times of market volatility.

For silver, there are 1099-B reporting requirements when selling bars in increments of 1000 ounces or more per transaction, or junk silver coins in increments of $1000 face value or more per transaction. All other coins or rounds are exempt from 1099-B reporting.

What Does ‘Brilliant Uncirculated (BU)’ Mean?

The term “Brilliant Uncirculated,” or BU, refers to coins that have not been in circulation or handled commonly like commercial coins. They show no significant wear. When privately held bullion coins have abnormal wear, they may be designated as ‘Almost Uncirculated (AU)’ or ‘common’.

A common mistake among buyers is to assume that BU coins possess the same qualities as “graded” coins. This is not the case. Imperfections in the minting process, or slight nicks and scratches, do not disqualify a coin from being designated “BU,” particularly when these coins were stacked one upon another in tubes while in transit. Customers who are seeking coins in perfect condition buy MS-70 graded coins, and they pay a higher premium for them.

What Is the Price of Silver?

Calculation for premiums on silver coins vary depending on current bullion market supply and demand factors, the type of bullion products being sold, government bureaucracy and taxation, and economic conditions at the local, national, and global levels.

The cost and spot price of silver fluctuates depending upon several factors:

- global commodity market rates

- sellers’ premiums over spot

- supply and demand equilibrium

- taxation rates

- economic conditions

The price for each ounce of bullion consists of the metal’s spot price and the bullion premium.

- The spot price is the current price per ounce exchanged on global commodity markets.

- The bullion premium is the additional price charged over its current spot price.

Spot prices are for “immediate delivery” and are distinct from futures prices, which indicate trade value for delivery at a future date. For silver, there are 1099-B reporting requirements when selling bars in increments of 1000 ounces or more per transaction, or junk silver coins in increments of $1000 face value or more per transaction. All other coins or rounds are exempt from 1099-B reporting.

Where Can I Check the Spot Price of Silver?

We publish live spot prices on our website. These prices originate from CME GLOBEX. Since precious metals are traded throughout the world on many exchanges, and since websites publish these prices at irregular intervals, it is common that slight variations in pricing exist between websites. For example, a website publishing prices from a certain exchange every two minutes will produce slightly different prices than another site publishing every twenty seconds from another exchange.

What Are Current Silver Coin Prices?

The silver market is much smaller than the gold market and tends to be a more speculative trade influenced by industrial demand (90% of all mined silver is used in industrial applications).

Current silver coin prices depend upon:

- the current silver spot price

- your seller’s premium

- world economic conditions

- geopolitical conditions

- Silver coin prices often move up or down in price, but when precious metals prices increase, silver tends to increase much faster than gold on a percentage basis. Conversely, when prices decrease, silver tends to decrease much faster.

Which Are the Best Silver Coins to Buy?

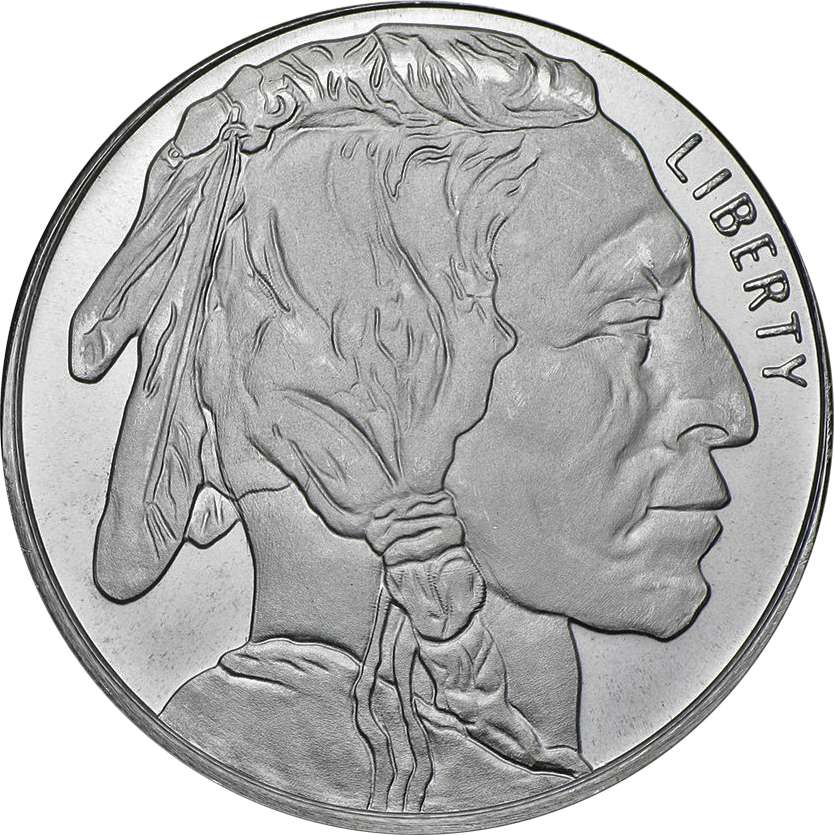

From the time coins were first struck with marks or images for identification and designation purposes, they have provided a unique record of anthropological interest to historians; many of the most popular coins today are those depicting engraved busts or biographic portraits of royalty or national leaders.

The most popular silver bullion coins in the world today are American Silver Eagle coins. The best silver coins to buy are the ones which:

- are most pure

- are most simple to buy

- have the least premium over spot

- are least susceptible to counterfeiting

- fulfill your preference for aesthetic design

- provide the best return on investment when resold

Your reason for buying silver coins will determine which silver coins are best for you. Coins purchased as gifts or collectible investments are often chosen because someone prefers their design; scarcity and demand also determine which coins are considered most collectible at any given point in time. Every year, both private and sovereign mints produce new coins with unique design variations, some of which are minted for a limited time only, thereby impacting their value and availability.

In 2014, to recognize its strong precious metals partnership, the government mint of Australia – The Perth Mint – issued a silver coin exclusively for commercial distribution by Texas Precious Metals. This coin is legal tender in Australia with a face value of AU$0.50. The Houston-Perth “Sister Cities” coin features offshore and onshore oil rigs showcasing the historic energy sectors of the two cities. The coin also pays homage to the flags of both Texas and Australia. This partnership was a testament to the growing worldwide credibility of Texas Precious Metals.

What Silver Coin Sizes are Available?

Silver coins are generally measured in troy ounces. Most people recall that an ounce is 1/16 of a pound, and when purchasing a half pound of roast beef at the deli, the butcher will hand you an eight-ounce package. This standard unit of commerce is technically referred to as an “avoirdupois” ounce, and it is used commonly for weighing everything except precious metals and gunpowder.

Precious metals, however, are measured in troy ounces, which is a unit of measure that dates to Roman times. A troy ounce is heavier than the avoirdupois ounce, and the conversion is as follows:

1 troy ounce = 1.09714286 avoirdupois ounces

So, do not be surprised if sixteen of your “one-ounce” 99.99% pure silver Canadian Maple Leaf coins weigh more than a pound on your kitchen scale. You have not won the lottery, unfortunately. You are simply using the wrong scale.

The first official U.S. silver dollar, depicting the head of a female allegorical figure representing Liberty, the Flowing Hair dollar of 1794-95, was minted in Philadelphia on October 15, 1794, in accordance with the Coinage Act of 1792.

The most commonly purchased silver bullion coins are one-troy ounce coins.

The disadvantage to smaller denominations is that, as a rule, the smaller the denomination the higher the premium on a percentage basis. (It is more expensive to mint ten of the one-tenth ounce coins than a single one-ounce coin.) For larger investors, the higher premium costs with smaller denominations can become prohibitive, so it is common for larger orders to veer toward one-ounce and ten-ounce denominations of gold and 100-ounce denominations of silver.

Texas Precious Metals Silver Rounds

No product is more closely associated with Texas Precious Metals than the “Texas Silver Round,” which in its first six years grew to become one of the most popular precious metals products in the United States. From 2013-2018, Texas Precious Metals sold more than 2.5 million Texas Silver Rounds into circulation, and it helped our brand, Texas Mint, become a household name for precious metals in Texas.

The Texas Silver Round has become a staple in the precious metals industry by offering investors a unique value proposition. This one ounce, finely struck medallion is purer than a US Mint Silver Eagle (.9999 fine vs. .9993), less expensive by nearly $1 per ounce at the retail level, and packaged in superior boxes comprised of steel, which is distinct from the common plastic containers issued by government mints.

Built from durable cold-rolled steel and finished with a matte black powder coat, the monster box lid features an orange cutout of the state of Texas. Each sealed monster box is secured with a unique serial number and a holographic seal to ensure maximum product protection.

The Texas Silver Round is also available to purchase in a similarly designed and secured mini-monster box, which contains ten protective tubes of twenty-five rounds each for a total of 250 silver rounds.

Is It Safe to Buy Silver Online?

More than 85% of all the metal we sell originates from the sovereign or private mint producing the coin. When we purchase silver bullion from third party sellers such as clients or other dealers, we test every single product that enters our vault using a combination of methods ranging from water density testing to X-ray fluorescence, as well as other machine protocols.

Some of the processes undertaken to guarantee the purity and verity of your purchase include:

- We open sealed monster boxes or coin tubes only to fill orders of uneven increments.

- Many mints now include security features on their metal; for example, all Sunshine Mint brand bullion products have a micro-engraving that is only visible by placing the Mint Mark SI™ decoding lens over the security pad.

- All packing operations are videotaped. If a rare mistake is made, we will review our video logs.

- We will happily and promptly correct any shipping mistakes.

- If a package is lost or stolen in transit, we will file a claim and issue you a new package.

- For security reasons, we restrict clients from contacting UPS or FedEx to change delivery instructions.

- We will not ship to mail forwarding companies, PO Boxes, APOs/FPOs, or US territories.

How to Buy Silver from Texas Precious Metals

Texas Precious Metals does not employ salespeople, and there are no commissions or sales pitches. Our staff exists for only one purpose: to facilitate a low cost, friendly, and efficient purchase.

Buying silver bullion coins has never been easier:

- Orders may be placed online 24/7/365 or by phone at 361-594-3624, M - F, 8 a.m. - 6 p.m. CST.

- There is no additional cost when ordering by phone and available free shipping on all orders.

- Payments may be made by credit card, bank wire, check, cash, or bank draft.

- Order Invoices and confirmation receipts of payment are sent by email.

Silver Coins FAQ

- What are coins made of? United States minted pennies today consist primarily of copper plated zinc. The silver-colored quarter, nickel and dime coins, are made using a copper-nickel combination.

- What are nickel coins made of? United States minted nickels, issued since 1866, are composed of 75% copper and 25% nickel.

- How much is a silver dime worth? Silver circulated coins dated 1964 or prior have a base value dependent the current silver price, so their value is determined based upon their silver content (90% silver/10% copper).

- What are the years of 40% silver coins? (1965-1970) In 1965 the U.S. government eliminated silver from quarters and dimes, but only reduced the silver content of half dollars to 40 percent (silver clad) out of respect for the recently slain US president John F. Kennedy. Silver was eliminated entirely from the coins in 1971.