Big Breakouts Across Metals Complex: Gold, Silver, Miners

Precious metals prices broke out this morning above key resistance levels in the mining sector as well as the underlying futures market for the raw metal.

Silver

In my post from June 10th, I mentioned 18.90 as a key initial target for silver. This level at sub-$19 has been an importance resistance level in silver for four years, getting rejected each time except for the false breakout in September. The breakout here is meaningful. The 14-day RSI (Relative Strength Index) is still not overbought and price looks like it has some room to run. The next target is $21, which represents the 161.8 Fibonacci extensions from the February/March high/lows.

Pan American Silver (PAAS), one of the leading silver mining stocks, also broke out this morning with a gap up above the 127.2 fibonacci Extension from the February/March high/lows. This move follows a multi-week basing period and targets just under $36 on this initial thrust, which is the 161.8 fibonacci extension.

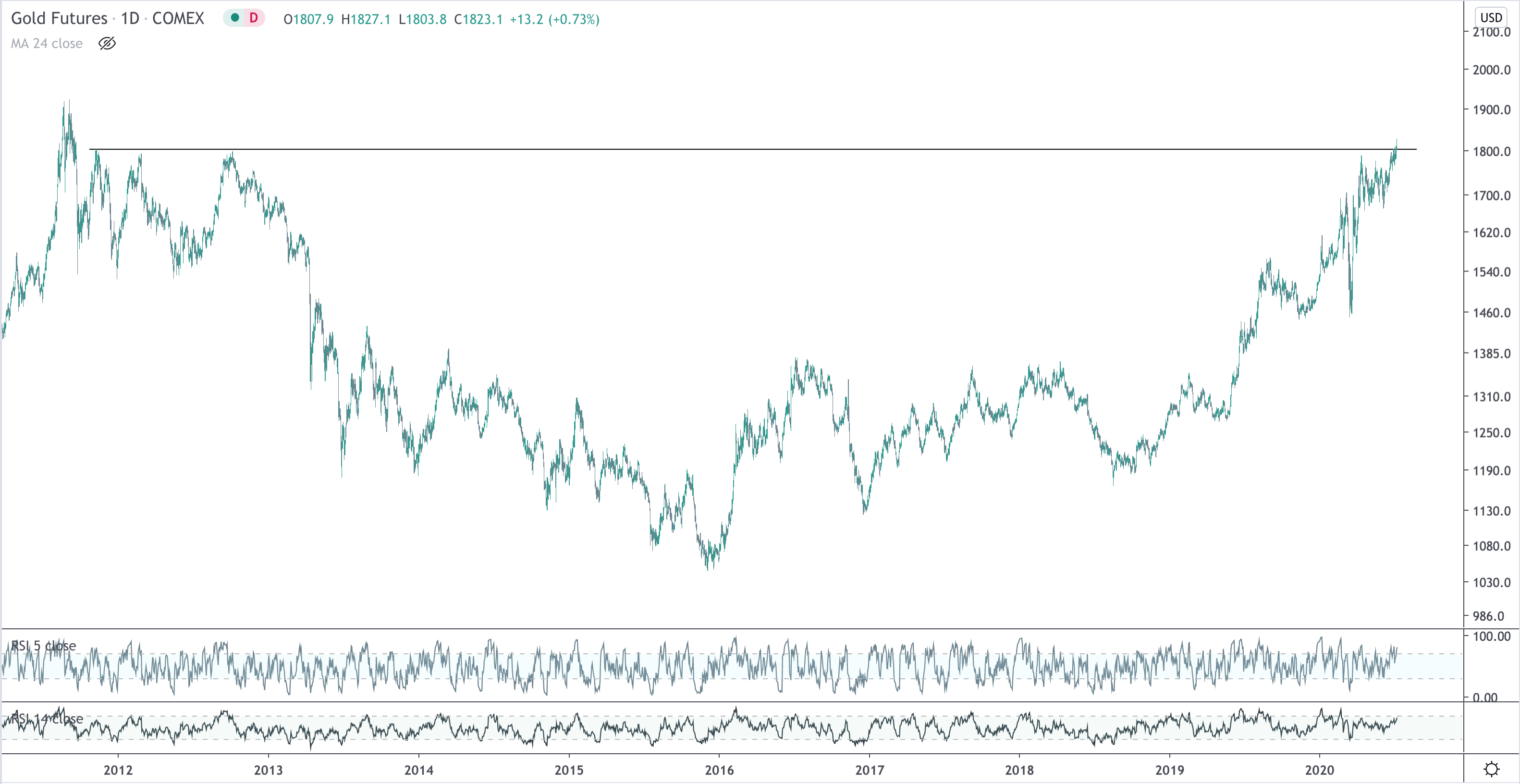

Gold

I have always viewed this $1800 price level in #gold as more significant than the $1910 blowoff top in 2011. The price level at $1800 was the multi-month, triple-tested resistance level that precipitated the 6-year base. If price holds, the breakout above this level is secular and very bullish, in my opinion, with the initial target at $2,000/ounce, or the 127.2 fib extension.

GDX

The Van Eck Gold Miners ETF had breakout and successful retest of the $32 level, broke out of the bull flag and is now taking out the May peak. My target is $42, which is the 161.8 extension from the Feb/March high/lows.

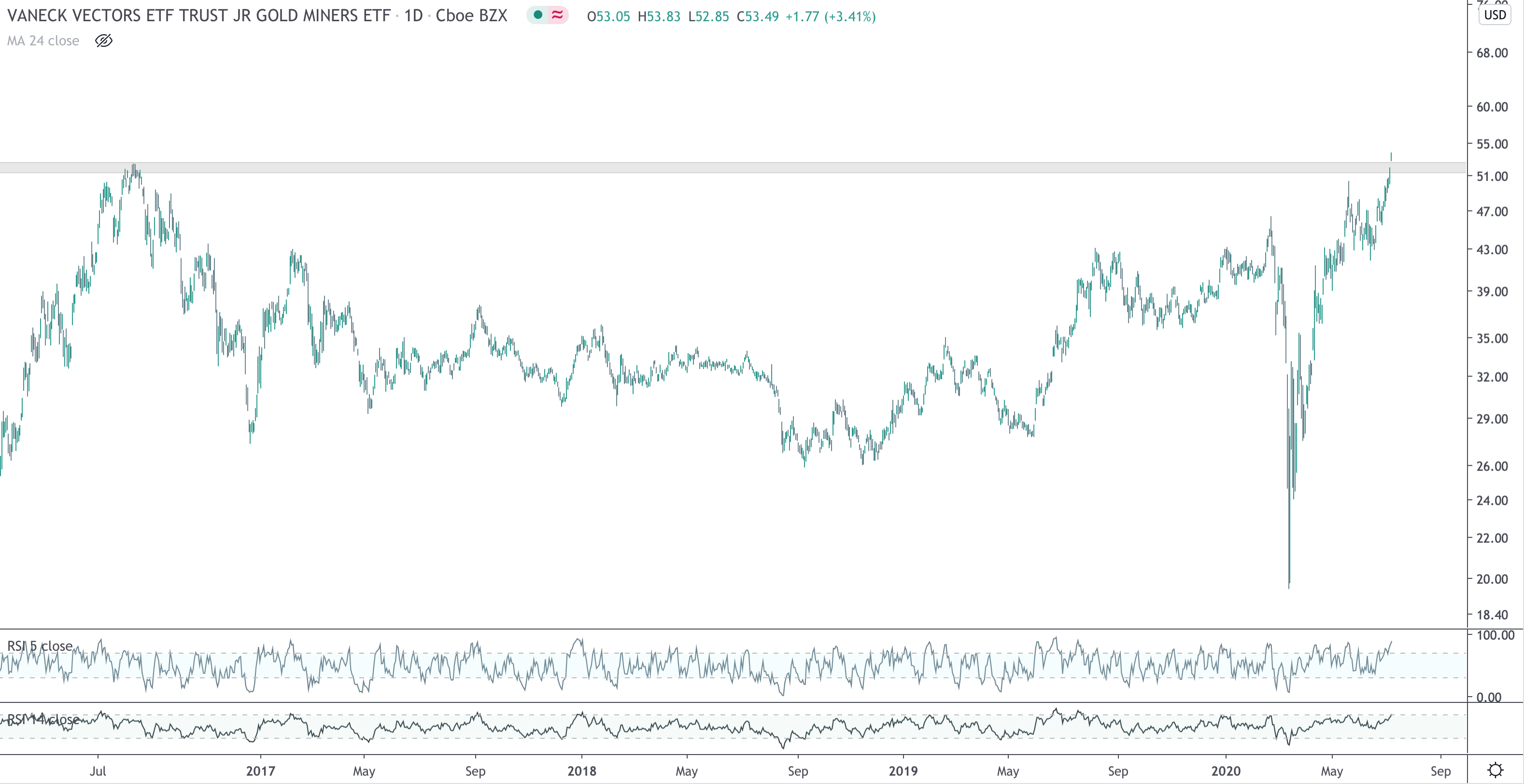

GDXJ

The Van Eck Junior Gold Miners ETF has been the laggard, but it is finally finally retesting the 2016 peak. Price has some room to run here and a bullish breakout/retest would be a great setup to add to long positions. The RSI hasn't been overbought on the daily chart since July 2019. Now would be a good time to show some strength.

As always, we look forward to your feedback. Be safe out there!

Sorry, you must be logged in to post a comment.