Gold and Silver Coiling for a Move

It has been over a month since my last entry on the markets, and aside from a few Twitter posts, most of my analysis has been confined to my desktop. The impact of the coronavirus on the retail precious metals market has been historic, with dueling supply and demand shocks, and as president of Texas Precious Metals, my time has been consumed by day-to-day operations. I finally have a bit of a respite this afternoon to share a few thoughts on the metals markets.

GOLD

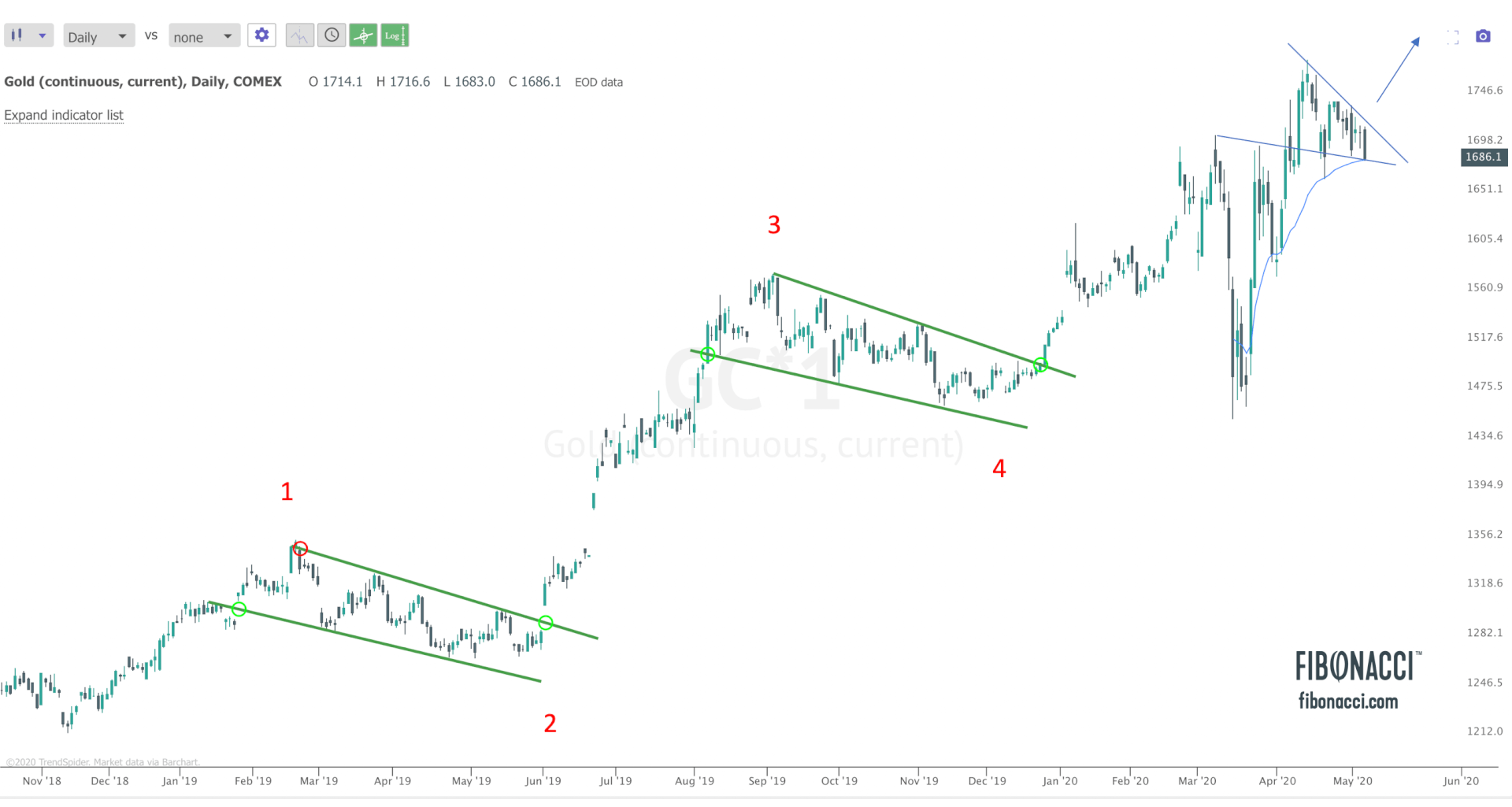

Back in November, I identified a 5-wave pattern setting up with two bull wedges that created a series of highly favorable long setups (see chart above). The big sell-off with the COVID debacle was concerning, but as we can see from the chart, horizontal support held and the bounce higher was strong and swift. It is possible (as some suggest) that Wave 5 is now completed, but I continue to think gold is pushing for all-time-highs based on price action and consolidation.

Also encouraging is the fact that gold is sitting right at the anchored VWAP (volume weighted average price) from the March 31st lows. (I used TrendSpider for this chart.)

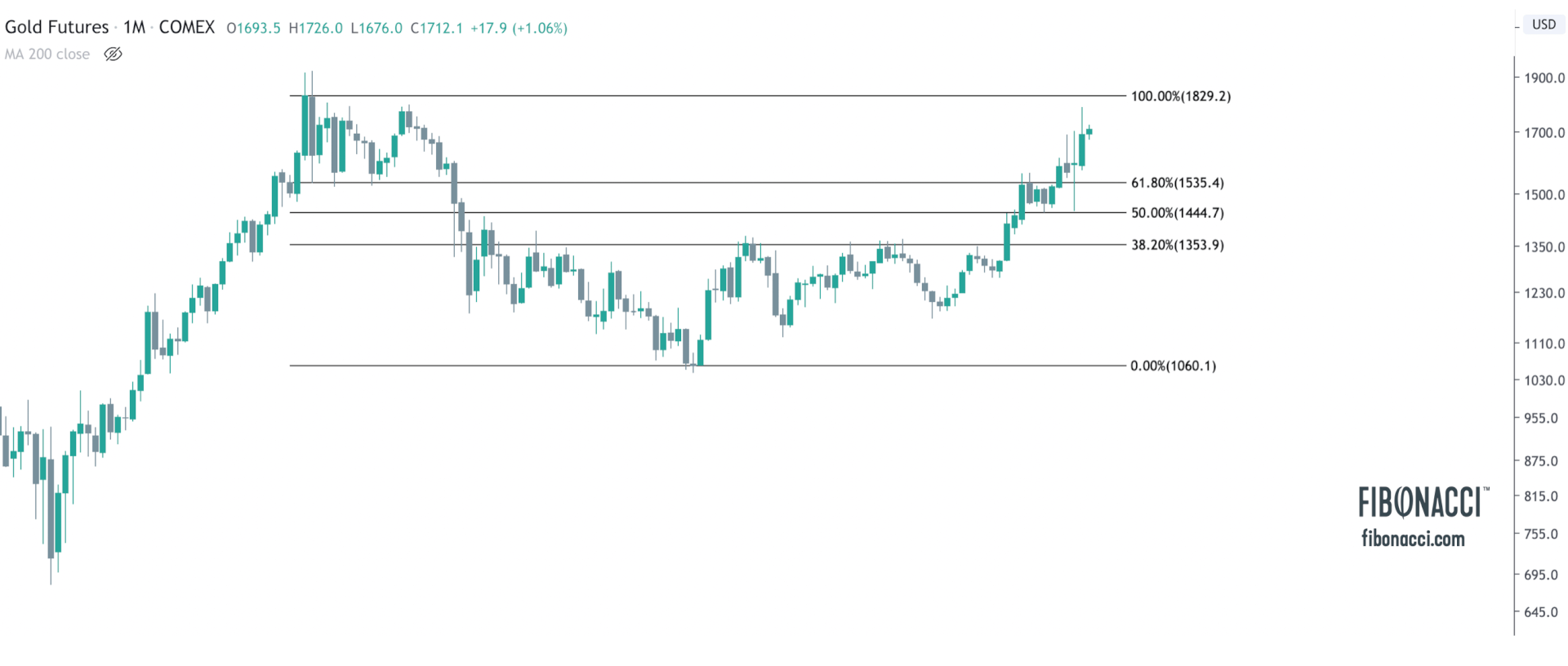

Zooming out to the monthly chart, the big selloff in March produced a long-legged doji that retraced the move to the 50% Fib retracement level (1450). Since that time, gold has rallied higher and seems to be pushing for a test of all time highs of $1910 (monthly close of $1830).

SILVER

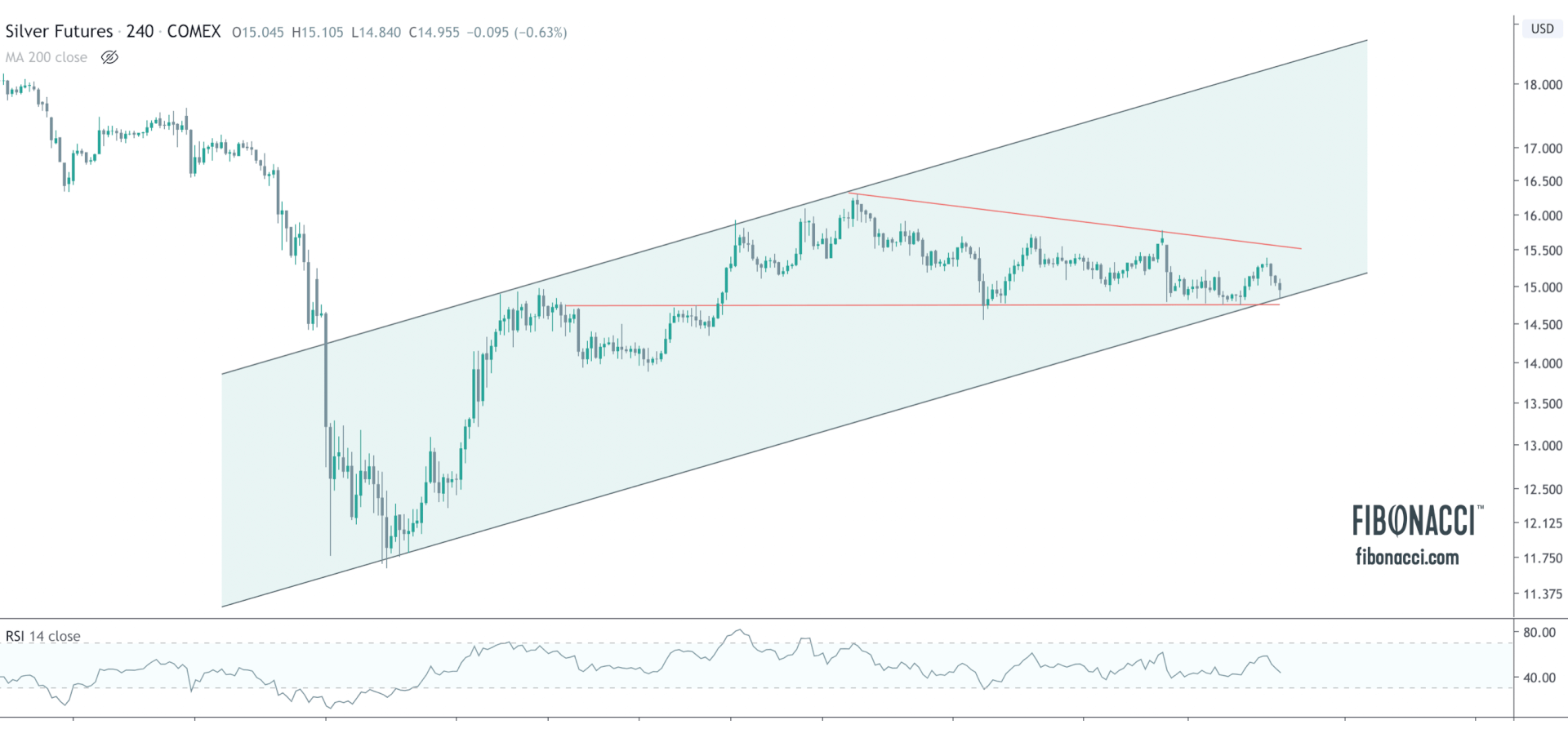

Silver is also coiling for a move, sitting at both horizontal support and rising channel support. From a risk/reward standpoint, a long entry here with a stop below 14.60 is favorable. The upside should target ~18.80.

S&P500

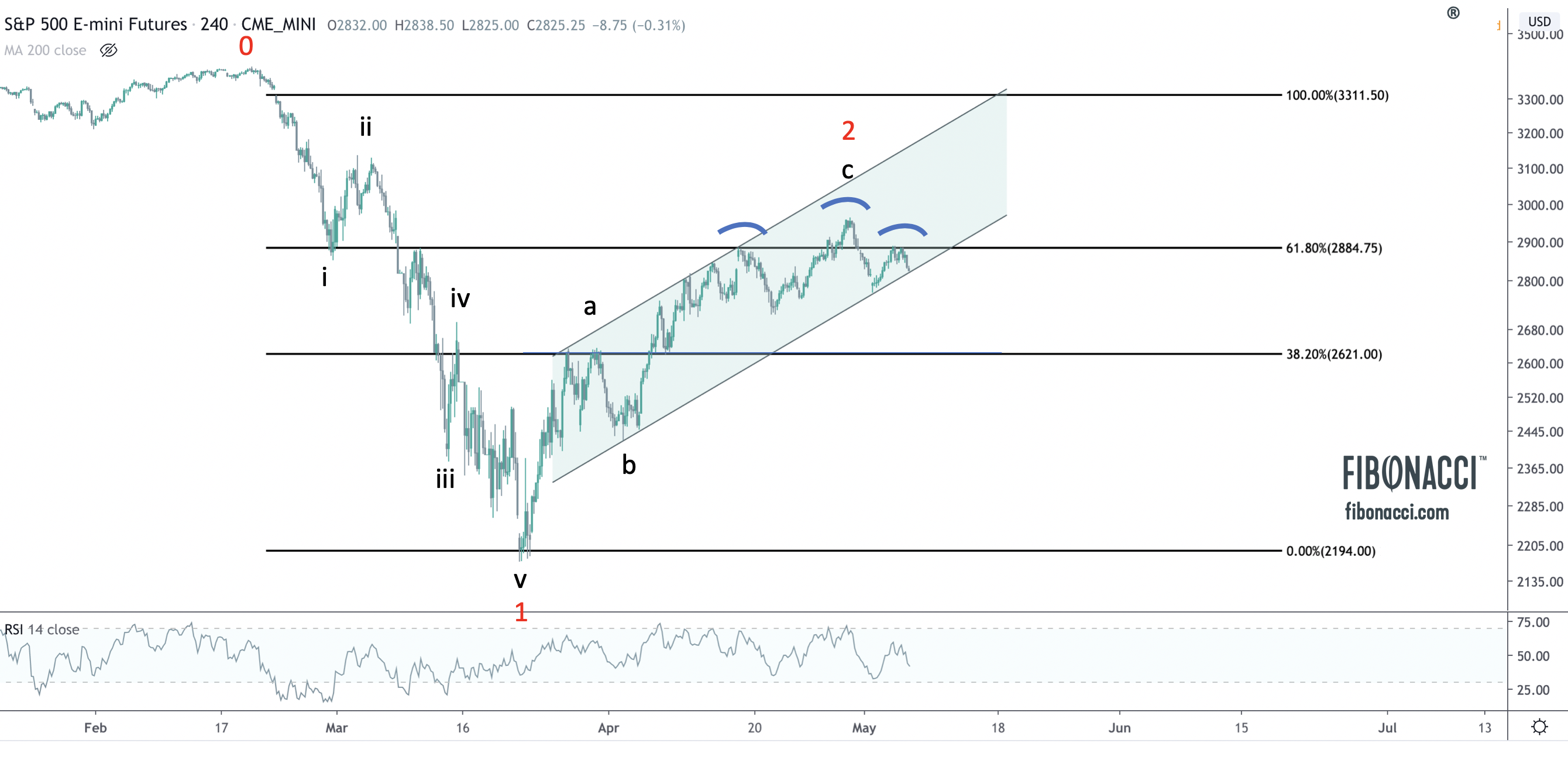

Lastly, just a quick comment on the S&P 500. The bearish case is that we have witnessed the beginning of 5 waves down, with wave 1 culminating in March and an A-B-C correction into April and early May. There is a head and shoulders top just below the 61.8% fibonacci retracement and a break of rising channel support would target 2620. The bulls would gain the upper hand if channel support holds and we break above 2940-2950 to the upside. A big rally to 3300 would likely ensue.

As always, we look forward to your feedback. Be safe out there!

Sorry, you must be logged in to post a comment.