Gold Demand Trends Full Year 2017

2017: Q4 recovery fails to mitigate full-year decline

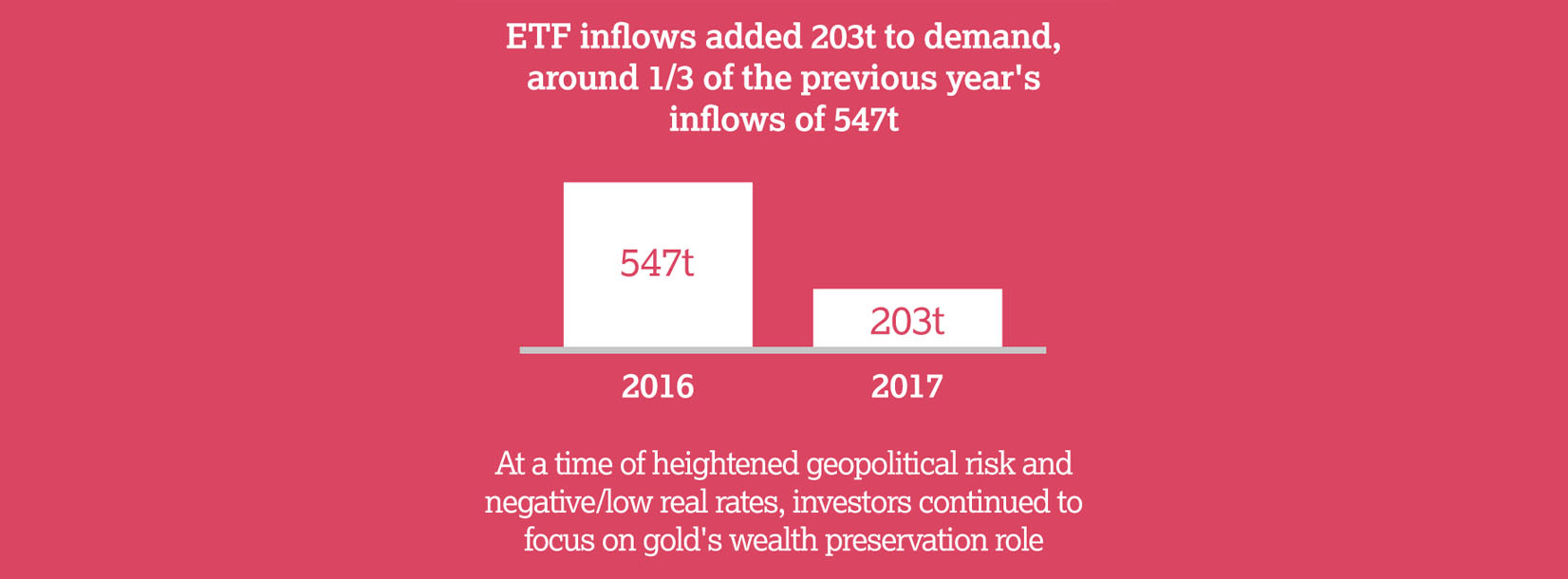

Gold demand rallied in the closing months of 2017, gaining 6% year-on-year (y-o-y) to 1,095.8 tonnes (t) in Q4. But it was too little, too late: full-year demand fell by 7% to 4,071.7t. ETF inflows, although positive, lagged behind 2016’s stellar growth. Central banks added 371.4t to global official gold reserves, 5% down on 2016’s net purchases. Bar and coin demand fell 2% on a sharp drop in US retail investment. India and China led a 4% recovery in jewellery, although demand remains below historical averages. Increased use of gold in smartphones and vehicles sparked the first year of growth in technology demand since 2010.

Highlights

Annual ETF inflows added 202.8t to demand, around one-third of 2016’s inflows. European-listed ETFs accounted for 73% of net inflows, with investors keenly attuned to geopolitics and negative interest rates.

Bar investment was broadly stable, while coin investment slid 10%. Weakness in the sector was largely explained by a sharp drop in US demand to a 10-year low of 39.4t, which exceeded strong gains in both China and Turkey.

First annual increase in jewellery demand since 2013 (+4%), but the sector remains weak in a historical context. Relatively stable prices and improving economic conditions paved the way for growth in 2017.

FOR MORE INFO, CLICK HERE.

Sorry, you must be logged in to post a comment.