Why Collectible Coins Fluctuate in Value

Collectible coins, unlike stocks and commodities, tend to have stable values. They are largely immune from sudden and pronounced price gyrations. With that being said, coins do fluctuate in value from time to time. While their price movements may not be nearly as dramatic as stocks and other commonly traded items, coins can and will change in value. This article will describe some of the influences on numismatic pricing.

Ultimately prices are a function of supply and demand—and the supply of rare coins can vary from time to time. When large collections are liquidated, it can have a profound impact on the marketplace. This is especially true for more specialized and “niche” areas of the market. For example, one of the largest collections of 17th century Massachusetts colonial coins was auctioned off in 2015. These are extremely valuable items—worth in the tens if not hundreds of thousands—but their collector following is quite narrow. When dozens of pieces hit the market all at once, prices fell considerably.

On the demand side, the biggest influence on value is marketing. When a large numismatic retailer decides to promote a certain type of coin, the net result is a large influx of buyers. These marketing campaigns bring certain coins into the spotlight and create new collectors. A similar phenomenon often happens when a new reference book is published about a certain series. The increased attention creates fresh demand for the coins.

Sometimes coins rise in value due to coincidental factors. If two deep-pocketed collectors decide to pursue the same series at the same time, prices can spike dramatically. This is especially true for auctions where emotions can overtake logic. When two collectors butt heads in an auction environment, the result can be previously unheard-of prices. Conversely, if a thin market is dominated by two large players, prices can tumble quickly if one collectors loses interest (or runs out of money).

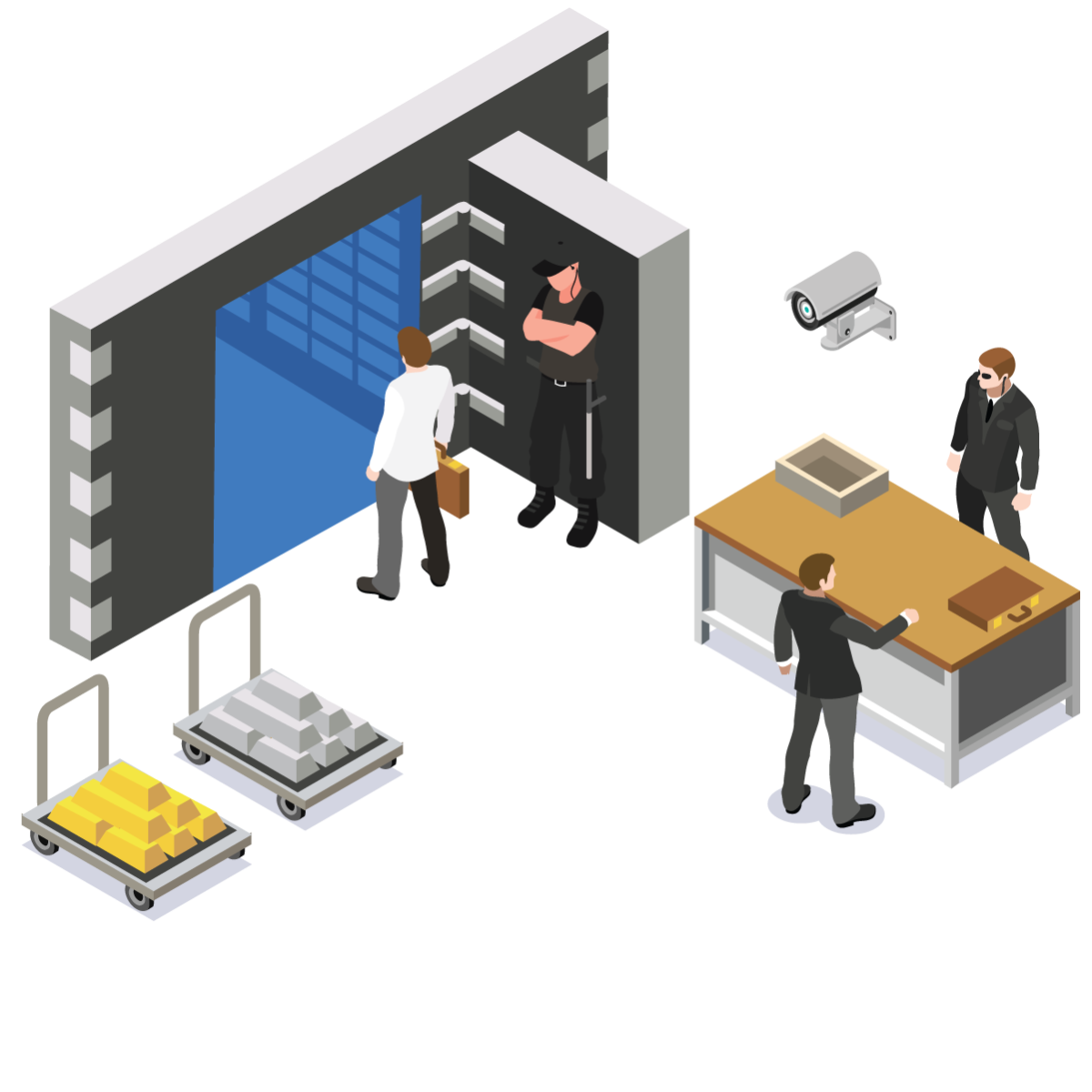

The bullion and numismatic markets are also linked, albeit somewhat indirectly. When precious metals are in the news and bullion is in demand, rare coins stand to benefit as well. Many bullion buyers wander into the numismatic world and eventually acquire rare coins for investment or collecting purposes. Not all bullion buyers make this transition but quite a few do—and many bullion retailers also offer rare coins for sale. Therefore, historically, active bullion markets have been good for rare coin values too.

Sorry, you must be logged in to post a comment.