World Gold Council Gold Demand Trends Q3 2014

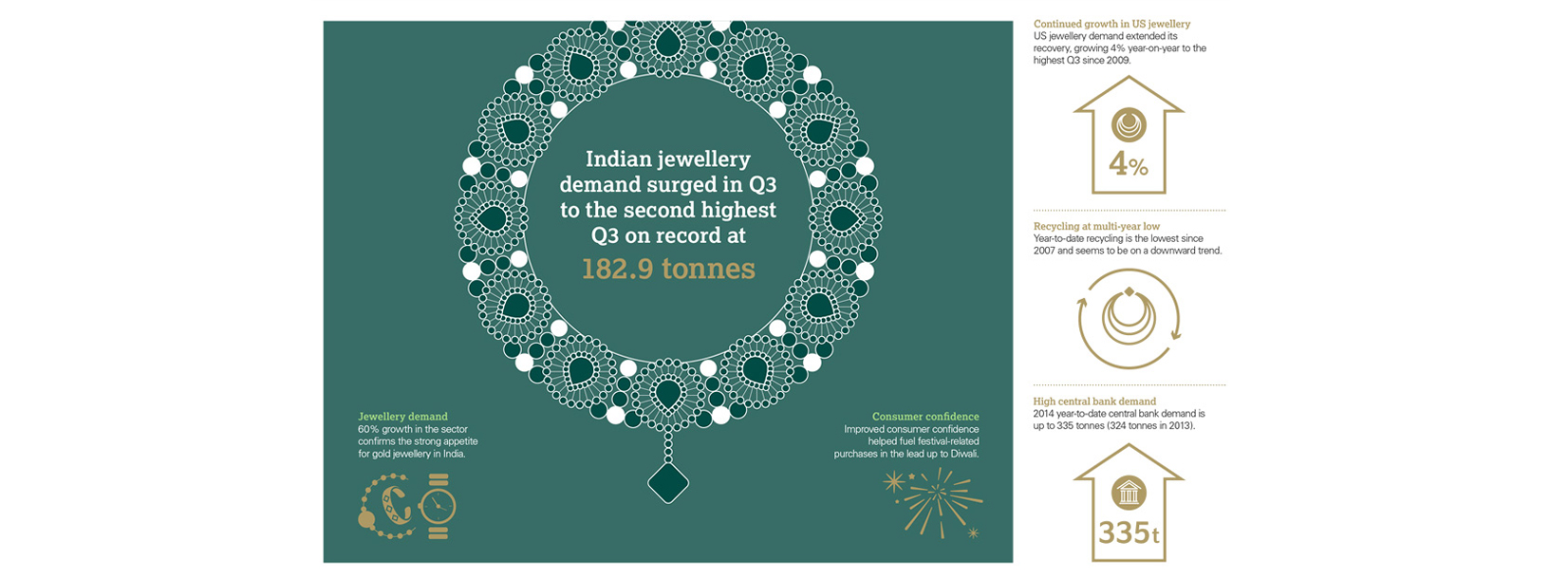

According to the latest Gold Demand Trends report from the World Gold Council, covering the period July to September 2014, global demand for gold was down just 2% year on year to 929 tonnes (t).

Investment demand, a combination of bars and coins and exchange-traded funds (ETF), was up 6% to 204t. However, investment in bars and coins was down 21% to 246t. This reflects an adjustment towards more normal levels of demand after a surge of unprecedented consumer demand took place last year. ETF outflows stood at 84t for the year to date compared to 699t in the same period last year. Third quarter demand for bars and coins was very close to the 10-year quarterly average of 240.6t. It’s worth noting that before the financial crisis of 2008, the European bar and coin market was virtually non-existent.

Gold demand and supply statistics for Q3 2014

- Gold demand for Q3 2014 was 929t, down 2% year on year from 953t.

- Central bank purchases declined 9% year on year, to 93t from 101t.

- Total bar and coin demand fell by 21% year on year, to 246t from 312t.

- ETF outflows were 41t, compared to 120t in the same period last year.

- Total jewellery demand fell by 4% year on year, to 534t from 556t.

- Technology declined by 5% to 98t compared to 103t in Q3 2013.

- Total supply fell by 7% to 1,048t compared to 1,129t in the same period last year.

Sorry, you must be logged in to post a comment.